Globally, leading telecom and technology organizations are evolving as a result of the current COVID-19 crisis in order to satisfy a greater demand for connectivity worldwide. Right now, they are adapting to the new market and their limitations, as well as the pressures of the business model in the area of sales, service, security and support. We consider that the following 4 Post-COVID-19 key trends are key in the telecom industry, thanks to the higher demand and the current needs due to the crisis, investments in the industry have increased and accelerated both in the private and public sector.

In this article we will talk about 4 key trends that will promote changes in the telecom industry.

4 Post Covid key trends in telecom

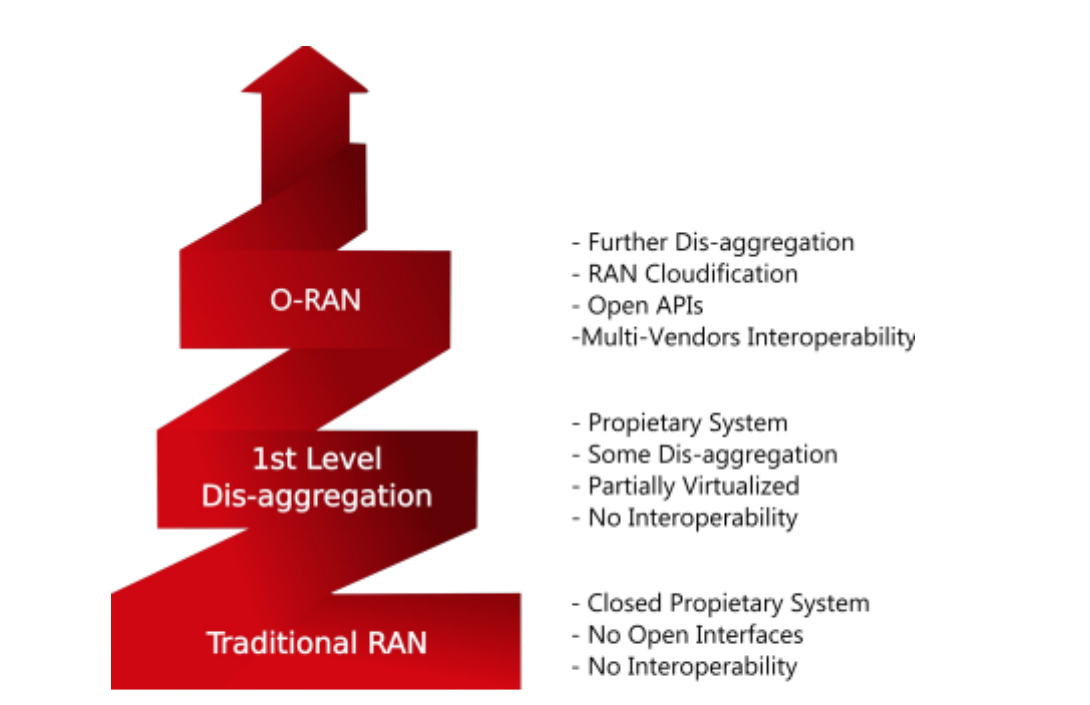

1. Intelligent edge

Intelligent Edge is one of the 4 key trends in telecom. It’s actually a key element to generate business information that smooths digital transformation. It is the combination of advanced connectivity, compact processing power, and artificial intelligence (AI) located near devices that use and generate data. Those basic opportunities are based on specific benefits that businesses can enjoy by using computing resources at the Intelligent Edge.

The 3 C’s of the Intelligent Edge

In words of Tom Bradicich «the usefulness of the Intelligent Edge is revealed when we unpack the three Cs:

- Connect: When devices, people, or things connect via networks, it facilitates data exchanges that promote new sources and quantities of data.

- Compute: Systems can then compute this data, provide access to applications, and reveal deep insights concerning the connected things, devices, and the surrounding environment.

- Control: These computed insights can then be used to take action, control the devices and things at the edge, or prompt other types of control actions associated with the business or enterprise to which the edge is connected.»

Figure 1. Intelligent Edge

«Deloitte predicts that in 2021, the global market for the intelligent edge will expand to US$12 billion, continuing a compound annual growth rate (CAGR) of around 35%. Expansion in 2021 will be driven primarily by telecoms deploying the intelligent edge for 5G networks, and by hyperscale cloud providers optimizing their infrastructure and service offerings. These highly capitalized leaders are establishing the use cases and best practices that may make it easier for companies across multiple industries to attain the capabilities of the intelligent edge. By 2023, 70% of enterprises may likely run some amount of data processing at the edge. As one leading graphics processing unit (GPU) manufacturer has stated, “We’re about to enter a phase where we’re going to create an internet that is thousands of times bigger than the internet that we enjoy today.”

«The intelligent edge can benefit any business that manages infrastructure, networks, clouds, data centers, and connected endpoints such as sensors, actuators, and devices. It can support consumer use cases that require very low latency, such as cloud gaming and augmented and virtual reality. It can enable enterprise uses that require aggregating, securing, and analyzing a great deal of data across operations and customers. And it can improve industrial processes for managing quality, materials, and energy use, such as monitoring factory floors, assembly lines, and logistics.» … « Not all businesses will be able to implement intelligent edge solutions broadly right away. Many may need to invest in the right infrastructure and partnerships first before seeing a return on investment from narrow use cases. But laying these foundations can give organizations much greater opportunities in the future.»

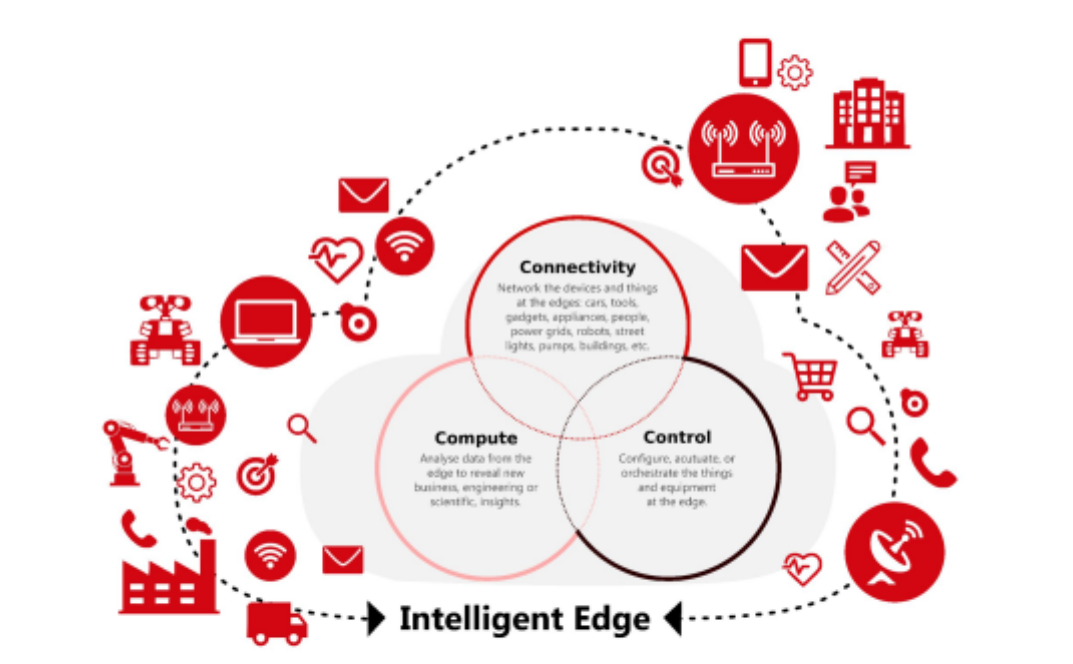

2. Open and virtualized RANs

Open RAN is a hot topic in mobile telecoms. At its simplest, Open radio access network (RAN) is a term for industry-wide standards for RAN interfaces that support interoperation between vendors’ equipment. Open RAN allows service providers to speed up 5G network development through its open architecture.

«The main goal for using open RAN is to have an interoperability standard for RAN elements such as non-proprietary white box hardware and software from different vendors. Network operators that opt for RAN elements with standard interfaces can avoid being stuck with one vendor’s proprietary hardware and software.

Open RAN is not inherently open source. The Open RAN standards instead aim to undo the siloed nature of the RAN market, where a handful of RAN vendors only offer equipment and software that is totally proprietary.

The open RAN standards being developed use virtual RAN (vRAN) principles and technologies because vRAN brings features such as network malleability, improved security, and reduced capex and opex costs. »

Open RAN is becoming a disruptive trend that moves the telecommunications infrastructure from static to dynamic; and the key element is the integration for the adoption of Open RAN as has mentioned Patrick Filkins, senior research analyst of IDC he said “The elephant in the room regarding Open RAN is, of course, integration.”

Previously, companies were vertically integrated and hardware-centric. Now the new approach with Open RAN must be based and driven by software, preferably open where the software communicates with all physical components, at any time, to offer scalability, innovation and change the landscape of how open networks are integrated.

“The key with Open RAN is that the interface between the BBU and RRU / RRH is an open interface, so, any vendor’s software can work on any open RRU / RRH. More open interfaces enable the use of one supplier’s radios with another’s processors – which is not possible with CRAN or vRAN.”

“In traditional RAN deployments, the software and interfaces remain either proprietary or “closed” by the individual vendor and are often tied to the underlying hardware by the SAME vendor. Meaning, operators cannot put vendor B’s software on a BBU from vendor A or connect a radio from vendor A to a vBBU hardware and software from vendor B. Any software upgrades are tied into the installed base, and if an operator wants to do a vendor A swap, they need to rip out all of it: from the vendor A radio to the vendor A BBU hosting the vendor A software – they cannot replace just one component in the legacy RAN deployment. This creates a vendor lock-in.”

To describe the concept in a simpler way we present the following image:

Figure 2. RAN Diagram

3. SASE Convergence

Secure Access Service Edge (SASE) – defined by Gartner – is a security architecture that establishes conversions of security and network connectivity technologies on a platform delivered through the cloud to enable fast and secure transformation of the cloud. SASE’s convergence of network connectivity and network security addresses the challenges of digital business transformation, edge computing, and employee mobility.

According to Cisco some benefits by consolidating SASE’s model enterprises can: “Reduce costs and complexity. Provide centralized orchestration and real-time application optimization. Help secure seamless access for users. Enable more secure remote and mobile access. Restrict access based on user, device, and application identity. Improve security by applying consistent policy. Increase network and security staff effectiveness with centralized management” .

«The Gartner SASE architecture provides for the dynamic creation of a secure, policy-based access service perimeter, regardless of the location of the entities requesting the capabilities, and regardless of the location of the network capabilities to which they request access. From a security point of view, SASE is the convergence of the unified offering of threat and data protection capabilities. This converged service relies on a continuous, low-latency presence, very close to the location of users wherever they are.

Although SASE platforms are not going to be installed overnight, the path to SASE is gaining in speed and urgency and, as Gartner anticipated, “by 2024, at least 40% of companies will have clear strategies for adopt SASE, up from 1% at the end of 2018 “.1 The reality is that the adoption of SASE has accelerated significantly in the last 18 months in part because the pandemic has forced companies to transform their human resources in workforces composed mainly of teleworkers. More companies are looking for solutions to the challenge posed by SASE.»

In addition, Gartner recommends choosing suppliers that will control where the inspection is done, how traffic is routed, which is registered and where those records to meet privacy requirements and compliance in all geographies are stored.

Overall, Gartner expects widespread adoption of SASE is a journey of several years, especially for large companies where network equipment and security remain separate. Because of this, the group of analysts advises companies to limit the duration of contracts to three years or less as they move to adopt new SASE technologies.

4. 6G

The 6G race has started. Said simply and directly, it aims to promote mobile networks as the base infrastructure on which all economic activities – industrial and services – are mounted, where Artificial Intelligence (AI) acts as the modeler of this new concept of infrastructure.

Ryuji Wakikawa, vice president and head of the Advanced Technology Division of SoftBank reviewed the evolution of 4G to 5G networks, the first oriented for smartphones, the second for new services. And he ventured that 6G will transform those networks into infrastructures that will support the digitization of all industries. “With 6G, every business in Japan will be conceived under this new concept of mobile networks because the Internet will be transformed into a single infrastructure for communications around the world.”

The proposal is underpinned by Beyond 5G, the consortium promoted by the government of Japan, aimed at exchanging experiences between the public, private and academic sectors to precisely accelerate development and innovation around 5G. But he wants to go much further than this initiative.

In the document, published on its website, it is noted that just as the era of 5G will bring ultra connectivity, ultra low latency and ultra speed, 6G will be the technology that will bring deeper innovations, aligned with AI and the new services, facilities and benefits that could be triggered by this technology, including greater energy efficiency. In the conception of SoftBank on 6G, goals of caring for the environment are also contemplated.

There are the 12 challenges for 6G pointed out by the team of SoftBank, those challenges are architectural, technological, and social. This company is taking up the challenge of resolving numerous issues in different areas,” with the service provider, which plans to invest 2.2 trillion yen (US$20.13 billion) during the next 10 years on its 5G and 6G networks. In the image below we showcase these 12 challenges.

If you are interested to want to know more about the Post Covid Key trends in telecom and how Chakray can help you, then contact us!